CLEVERPAYS FOR retail

Code of Conduct for the Credit and Debit Card Industry in Canada

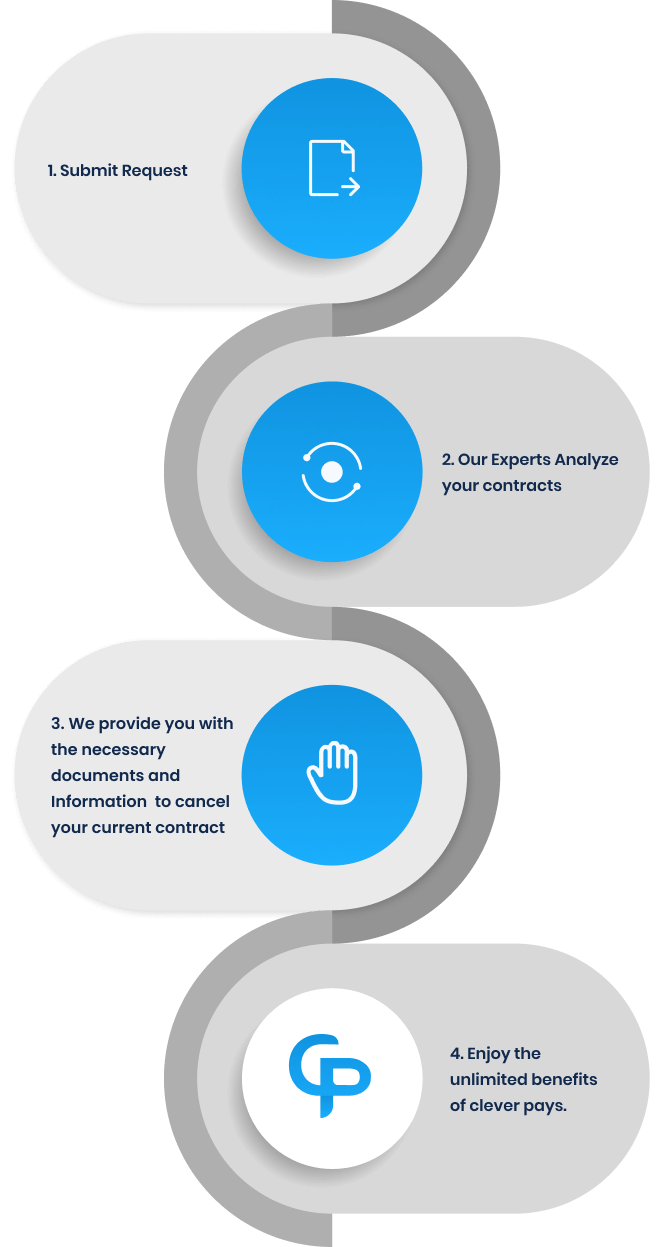

What Cleverpays can do for you:

Current CCOC in effect:

Version currently in effect:

Version 1.0

Purpose

The purpose of the Code is to demonstrate the industry’s commitment to:

- Ensuring that merchants are fully aware of the costs associated with accepting credit and debit card payments, thereby allowing merchants to reasonably forecast their monthly costs related to accepting such payments

- roviding merchants with increased pricing flexibility to encourage consumers to choose the lowest-cost payment option.

- Allowing merchants to freely choose which payment options they will accept.

Disclosure

Scope

The Code applies to credit and debit card networks (referred to herein as payment card networks) and their participants (e.g. card issuers and acquirersFootnote1 ).

The payment card networks that choose to adopt the Code will abide by the policies outlined below and ensure compliance by their participants (e.g. issuers, acquirers, and their downstream participants). The Code will be incorporated, in its entirety, into the payment card networks’ contracts, governing rules and regulations. The Code will apply within 90 days of being adopted by the payment card networks and their participants.

Enhancements to the Code announced on April 13, 2015 will apply within 9 months of being adopted by the payment card networks and their participants and will apply to all new merchant-acquirer agreements and all new or reissued premium cards after that 9-month period, with the following exceptions:

- Element 1: Acquirers will have up to an additional 9 months, for a total of 18 months from the date of adoption, to implement the changes to Element 1. These changes will be applied to all new and renewed merchant-acquirer agreements;

- Elements 2 and 3: The measures to facilitate the pass-through of interchange rate reductions to merchants will enter into force immediately for all merchant-acquirer agreements, upon adoption of the Code;

- Element 4: The extension of this principle to contactless payments will enter into force immediately for all merchant-acquirer agreements, upon adoption of the Code;

- Element 11: This element, which pertains to acceptance of contactless payments, will enter into force immediately for all merchant-acquirer agreements, upon adoption of the Code;

- Element 12: The principle that merchants can provide notice of non-renewal at any point during the contract period up to 90 days prior to contract expiry will enter into force immediately for all merchant-acquirer agreements, upon adoption of the Code. Acquirers will have 9 months from the date of adopting the Code to implement the changes addressing fixed-term contracts; these changes will be applicable to all merchant-acquirer agreements; and

- Element 13: The complaints handling process will enter into force for all merchant-acquirer agreements, within 60 days of adopting the Code.

To assist entities in adhering to elements of the Code, the following definitions are provided for clarification:

Contactless payment: a payment card-based and/or mobile device enabled payment transaction that is initiated at the payment terminal at a point-of-sale and that does not require contact with the payment terminal at the point-of-sale.

Mobile device: a portable electronic device that may be used by a consumer to facilitate the storage and/or transmission of data electronically for enabling a contactless payment.

Mobile wallet: a graphic user interface (software application) that presents one or more payment applets to a consumer for the purposes of enabling a contactless payment.

Payment applet: a software application on a mobile device, or within a mobile wallet, that enables a contactless payment by linking a single payment credential (e.g. credit or debit) through a specific payment card network.

Payment credential: the data that is required to complete a contactless payment (e.g. identifying information for the specific payment network, issuer and cardholder) that is stored securely and accessed by a payment applet or token associated with a payment applet.

This Code is overseen by the Financial Consumer Agency of Canada, which is responsible for monitoring the compliance of signatories.

Any device, effortless integration

Requirements for payment card networks

Policy elements

1. Increased Transparency and Disclosure by Payment Card Networks and Acquirers to Merchants.

The payment card networks and their participants will work with merchants, either directly or through merchant associations, to ensure that merchant-acquirer agreements and monthly statements include a sufficient level of detail and are easy to understand.

All merchant-acquirer agreements will include a cover page containing an information summary box that provides key elements of the contract in a consolidated fashion and a fee disclosure box, using the templates in Addendum I.

Acquirers must also disclose all other fees (e.g. monthly minimums, administration fees, etc.) charged to the merchant.

Payment card networks will make all applicable standard interchange rates and acquiring network assessment fees easily available on their websites. In addition, payment card networks will post any upcoming changes to these rates and fees on their websites once they have been provided to acquirers. Payment card network rules will ensure that merchant statements include the following information:

- Effective merchant discount rateFootnote3 for each type of payment card from a payment card network that the merchant accepts;

- Interchange rates and, if applicable, all other rates charged to the merchants by the acquirer;

- The number and volume of transactions for each type of payment transaction;

- The total amount of fees applicable to each rate; and,

- Details of each fee and to which payment card network they relate.

2. Payment card network rules will ensure that merchants will receive a minimum of 90 days’ notice of any fee increases or the introduction of a new fee related to any credit or debit card transactions, or a reduction in applicable interchange rates.Footnote4 Payment card networks will provide at least 90 days’ notice to acquirers for rate and/or fee changes and at least 180 days’ notice for structural changes.Footnote5

The notice to merchants must describe the nature of the fee change and the change must be clearly identifiable on the merchant’s subsequent monthly statement, to help merchants better understand the impact of the fee change.

Acquirers will also provide an updated fee disclosure box reflecting the impact, upon written request from the merchant, following a new fee or fee increase.

Notification is not required for fee changes made in accordance with pre-determined fee schedules, such as those based on merchant sales volume, provided that the schedules are included in the merchant’s contract.

3. Payment card network rules will ensure that following notification of a fee increase or the introduction of a new fee, or a reduction in applicable interchange rates not passed on to merchants, merchants will be allowed to cancel their contracts without penalty.

By signing a contract with an acquirer, a merchant will have the right to cost certainty over the course of their contract. As a result, in the event of a fee increase or the introduction of a new fee, merchants will be allowed to opt out of their contracts, without facing any form of penalty, within 90 days of receiving notice of the fee increase or the introduction of a new fee.

Merchants will also have the right to provide 90 days’ notice to exit their contracts without penalty in the event that acquirers do not pass-through the full savings from any reduction to payment card networks’ posted interchange rates that are applicable to that merchant, within 90 days of receiving notice of the interchange reduction.

This right includes relief from the application of any penalties on all related service contracts (e.g. terminal lessors, third-party processors) brokered by the acquirer and/or its registered agents, processors or other agents.Footnote6

Merchants may not cancel their contracts in relation to fee increases made in accordance with pre-determined fee schedules, such as those based on merchant sales volume, provided that the schedules are included in the merchant’s contract.

4. Payment card network rules will ensure that merchants who accept credit card payments from a particular network will not be obligated to accept debit card payments from that same payment card network, and vice versa.

Payment card networks will not require merchants to accept both credit and debit payments from their payment card network. A merchant can choose to accept only credit or debit payments from a network without having to accept both.

The same principle applies to credit or debit payment credentials accessed by consumers through a mobile wallet or mobile device. Merchants who accept a credit payment credential from a particular network, which are accessed by consumers through a mobile wallet or mobile device, will not be obligated to accept debit payment credentials from that network or vice versa.

5. Payment card network rules will ensure that merchants will be allowed to provide discounts for different methods of payment (e.g. cash, debit card, credit card). Merchants will also be allowed to provide differential discounts among different payment card networks.

Discounts will be allowed for any payment method. As well, differential discounting will be permitted between payment card networks.

Any discounts must be clearly marked at the point-of-sale.

6. Competing domestic applications from different networks shall not be offered on the same debit card. However, non-competing complementary domestic applications from different networks may exist on the same debit card. In mobile wallets or mobile devices, debit payment credentials from payment card networks must be represented as separate payment applets.

A debit card may contain multiple applications, such as PIN-based and contactless. A card may not have applications from more than one network to process each type of domestic transaction, such as point-of-sale, Internet, telephone, etc. This limitation does not apply to ABM or international transactions.

7. Payment card networks will ensure that co-badged debit cards are equally branded. All representations of payment applets in a mobile wallet or mobile device, and the payment card network brands associated with them, must be clearly identifiable and equally prominent.

Payment card network rules shall ensure that the payment networks available on payment cards will be clearly indicated. Payment card networks will not include rules that require that issuers give preferential branding to their brand over others. To ensure equal branding, brand logos must be the same size, located on the same side of the card, and both brand logos must be either in colour or black and white.

8. Payment card network rules will ensure that debit and credit card functions shall not co-reside on the same payment card, and that consumers shall have full and unrestricted control over default settings on mobile devices and mobile wallets to select such debit or credit payment applets.

Debit and credit cards have very distinct characteristics, such as providing access to a deposit account or a credit card account. These accounts have specific provisions and fees attached to them. Given the specific features associated with debit and credit cards, and their corresponding accounts, such cards shall be issued as separate payment cards. Consumer confusion would be minimized by not allowing debit and credit card functions to co-reside on the same payment card.

Credit and debit payment credentials can be stored on, or accessed by, the same mobile device or mobile wallet, provided that they are clearly separate payment applets, and consumers can select which payment applet shall be used for contactless payments.

Credit and debit payment credentials will only be issued to mobile devices or mobile wallets that do not have pre-set default preferences that cannot be changed and that provide consumers with full and unrestricted discretion to establish any default preference(s) for payment options. Selecting default preferences shall only be done by consumers based on a clear and transparent process, clearly accessible through the mobile user interface, and consumers should be able to easily change default settings in a timely manner.

9. Payment card network rules will require that premium credit and debit cards may only be given to consumers who apply for or consent to such cards. Premium cards, and the payment applets that link to premium card payment credentials, should clearly indicate that they are premium products (e.g. display clear and prominent branding used by the payment card networks to identify them as premium products). In addition, premium payment cards shall only be given to a well-defined class of cardholders based on individual spending, assets under management, and/or income thresholds and not on the average of an issuer’s portfolio.

Premium payment cards have a higher than average interchange rate. They must be targeted at individuals who meet specific spending, assets under management and/or income levels.

For payment card networks that have differential acceptance costs for premium cards, payment card network rules will require issuers to include a statement on all cardholder applications for premium cards disclosing that these premium cards can impose higher card acceptance costs on merchants. This disclosure should be featured prominently on the cardholder application.

10. Payment card network rules will ensure that negative option acceptance is not allowed.

If payment card networks introduce new products or services, merchants shall not be obligated to accept those new products or services. Merchants must provide their express consent to accept the new products or services.

11. Payment card network rules will not require that merchants accept contactless payments at the point-of-sale, or to upgrade point-of-sale terminals to enable contactless payments.

If a merchant chooses to accept contactless payments at the point-of-sale, the merchant shall be able to cancel the contactless acceptance on their terminal for each payment card network, with thirty days’ notice, while maintaining all other aspects of their existing contract without penalty.

Should fees set by a payment card network in respect of contactless payments made from a mobile wallet or mobile device increase relative to card-based contactless payments, the payment card network will develop the technical specifications to ensure that merchant acceptance of contactless payments made from a mobile wallet or mobile device can be cancelled at the point-of-sale without disabling other forms of contactless payment acceptance. Merchants shall be able to opt out of accepting contactless payments made from a mobile wallet or mobile device by giving 30 days’ notice to their acquirer (or applicable registered agent), while maintaining all other aspects of their existing contract without penalty.

12. Payment card network rules will require that information about merchant-acquirer agreements, including cancellation and renewal terms and conditions, will be disclosed in a way that is clear, simple and not misleading.Footnote7

Merchants may provide notice of non-renewal at any point during the contract period up to ninety days prior to contract expiry.

Fixed-term contracts will not be automatically renewed for the full initial term, but may convert to automatically renewable contract extensions of no longer than six months. Merchants may provide notice of non-renewal at any point during the extension period, up to ninety days prior to the end of each term.

This element applies to both the merchant-acquirer agreement and to any related service contracts with service providers. In situations where there is a business connection between the participant and the service providers, services are considered related and as a single service package.Footnote8

13. Payment card network rules will require that merchants have access to a clear dispute resolution process that provides for an investigation and timely response of complaints pertaining to the Code.

If a merchant believes that its service providers’ conduct is contrary to the Code, they may report the issue to their acquirer.Footnote9 Service providers include, but are not limited to, acquirers, processors, independent sales organizations and referral agents.

The acquirer will review the issue with the merchant, undertake an investigation and respond to the merchant within ninety days.

If the acquirer’s complaint process is exhausted and a satisfactory resolution not achieved, the merchant may submit the complaint to the payment card networks.

To facilitate the exchange of information, payment card networks will develop a common template and information requirements to facilitate the submission of a complaint by a merchant.

Payment card networks will investigate any complaints received from the acquirer, from FCAC or directly from a merchant, and will work with their participants to find an appropriate resolution and communicate the outcome of its investigation directly to the merchant, with a copy to the acquirer, within 45 days of receiving the complaint.

Acquirers will establish an internal complaints handling process and make information on their process easily available to merchants.Footnote10 At a minimum, the complaints handling process must adhere to the following standards:

- Acquirers will provide merchants with a summary of the complaint handling process and post it prominently on their website (a link to the website is to be included in the information summary box).

- Acquirers must acknowledge receipt of the merchant complaint within five business days.

- Acquirers must investigate all complaints and provide a substantive response to merchants that consists of either: (a) an offer to resolve the complaint; or (b) denial of the complaint with reasons.

- Acquirers must provide their final decision within 90 days of receiving the merchant complaint, along with:

- A summary of the complaint;

- The final result of the investigation;

- Explanation of the final decision; and

- Information on how to further escalate a complaint in the event of an unsatisfactory outcome, along with the complaint handling form.

- If acquirers cannot provide a response within 90 days, the merchant must be informed of the delay, reason for the delay, and the expected response time.

With the exception of the response time, each of these standards also applies to the payment card networks for investigating and responding to merchant complaints.

Payment card networks must be informed in writing of the aggregate number of any Code-related complaints received by acquirers, the nature of the merchant complaints, and the outcomes on a semi-annual basis. The payment card networks will also share the above information with the Financial Consumer Agency of Canada, as well as aggregate information on complaints resolved by the payment card networks.

Nothing in the above process restricts the merchant from directly filing complaints with the Financial Consumer Agency of Canada, or a payment card network, to investigate non-compliance with the Code.

Keep track of inventory sold online and in person

Footnotes

- “Acquirers” are entities that enable merchants to accept payments by credit or debit card, by providing merchants with access to a payment card network for the transmission or processing of payments.

- “Registered agent” refers to any merchant-focused sales actor that requires registration by an acquirer with a payment card network, either directly or through the sponsorship of an acquirer.

- The effective merchant discount rate is calculated as the total fees paid by the merchant to an acquirer, related to the processing of a specific type of payment card from a payment card network, divided by the total sales volume for that type of payment card.

- For greater clarity, “applicable” means only those categories of interchange rates that apply to the transactions originated by an individual merchant. For example, if rates for a specific industry program are reduced, but the transactions originated by the merchant do not qualify for those program-specific rates, then the merchant would not be entitled to pass-through of those program-specific reductions.

- Structural changes are significant changes to the fee structure for a payment card network. This includes the introduction of new types of interchange or other fees, a change to the interchange rate structure or the introduction of a new type of credit or debit card.

- The FCAC has released guidance that provides additional clarification on the extension of this element to multiple service provider contracts.

- The intention is to limit this element to standard-form contracts, i.e. those contracts that have not been custom negotiated between the parties with benefit of legal counsel.

- See FCAC Commissioner’s Guidance 10 for additional information on the interpretation of this clause.

- For the purposes of this element, acquirer is defined as the payment processing company (“processor”). Therefore, in cases where processing companies are sponsored by acquiring banks, the obligation for establishing the complaints handling process in the first step of the process will rest with the processor, not the acquiring bank.

- FCAC Commissioner’s Guidance 12 includes additional information on best practices for establishing an internal complaints handling process.

Footnotes

Information summary box

Date of contract(s)

Acquirer

Cancellation of contract(s) and any applicable penalties

Date that the contract can be cancelled without penalty; page in contract with information on cancellation procedures (including who to contact to cancel contract).

Complaint handling procedures

Contactless payments acceptance

Transaction return policy

Independent sales organization or referral agent (where applicable)

Information about credit and debit card service providers (if different from the acquirer)

Code of Conduct

Statements

Information summary box

Payment card type

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

Visa Classic

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

Visa Infinite

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

Visa Infinite Privilege

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

Visa Business

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

MasterCard Classic

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

MasterCard World

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

MasterCard World Elite

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

MasterCard Business

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

Discover

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

MasterCard Debit

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

Visa Debit

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

Interac Debit

Processing method A (definition)

Processing method B (definition)

Processing method C (definition)

Let’s talk payments.

Friendly service, future proof technology, dedicated support.

Fast & Easy Setup

Get started with Cleverpays in just minutes.

Lower Rates

Everything you need to sell in-person and online.

Smarter Tools

Everything you need to sell in-person and online.

No Contracts or Monthly Fees

Get full access to our great payment tools for free.

Have Us Contact You.

Feel free to reach out through the contact form below, and we’ll get back to you promptly to assist with your inquiry.