Understanding Credit Card Payment Processing as a small business

Understanding how payments work in Canada can help your business save money and make informed decisions. This guide breaks down the key players in the payment ecosystem, the fees involved (like interchange and network fees), and how a card transaction flows from customer to merchant. We also cover the regulations and trends shaping payment processing in Canada, from Interac debit to digital wallets and upcoming real-time payment systems.

How the Payment Ecosystem Works in Canada

In Canada’s payment processing ecosystem, several players work together behind each transaction:

- Cardholder— – The customer who uses a credit or debit card to buy goods or services.

- Merchant—The business that accepts card payments in exchange for goods or services.

- Issuing Bank—The cardholder’s bank (or credit card issuer) that provides the card and pays the transaction amount to the acquirer on the customer’s behalf.

- Acquiring Bank (Acquirer) – The merchant’s bank that processes card payments for the merchant. The acquirer receives payment details from the merchant and sends them through the card network to the issuer. They also deposit funds into the merchant’s account after settlement.

- Card Networks—The payment networks (e.g., Visa, Mastercard, and Canada’s domestic Interac for debit) that connect issuing and acquiring banks. They set transaction rules and fees (like interchange) and ensure payments transfer securely between banks.

- Payment Processors—Companies like CleverPays that act as intermediaries providing the technology to accept card payments. They route transactions from the merchant’s point-of-sale system or website to the acquirer and card network. Processors often provide card machines, online payment gateways, and customer support to merchants, making it easier to integrate and manage payments.

These players work together so that when a customer taps or swipes a card, the payment information travels from the merchant to the issuer and back, and the appropriate fees are applied along the way. For example, Visa and Mastercard facilitate credit card payments, while Interac is the network that handles most Canadian debit card transactions directly between banks. Each party has a role: the issuer authorizes payment and bears the risk of the cardholder’s credit, the network transmits the transaction securely, the acquirer ensures the merchant gets paid, and the processor ties it all together with the merchant’s sales system.

Interchange Fees in Canada

Interchange fees are at the core of card payment costs. Interchange is a fee set by the card network that the merchant’s bank (acquirer) pays to the cardholder’s bank (issuer) for each card transaction

visa.ca. Although the acquirer pays this fee upfront, it passes the cost to the merchant as part of the merchant’s transaction fees. In other words, whenever a customer pays by credit card, a percentage of that sale goes to the issuing bank as interchange (this is built into the rate merchants pay their payment processor or acquirer). Consumers themselves do not directly pay interchange—it’s charged behind the scenes to the merchant’s bank.

How much are interchange fees? It depends on the type of card and transaction. Credit card interchange rates in Canada typically range from around 1% up to 2.5% of the transaction amount. Basic cards (no rewards) have lower interchange rates, while premium reward cards have higher rates to fund those points and cashback programs. For example, for an in-person card-present transaction, a basic Mastercard might have an interchange around 0.92%, whereas a premium Visa Infinite card could be about 2.08%.

If the sale is online (card-not-present), interchange is slightly higher on average (to account for higher fraud risk)—e.g., around 1.45% for a no-frills card up to 2.54% for a premium card.

Debit cards (Interac) work differently. Interac charges a much smaller, flat fee per transaction instead of a percentage. Canadian merchants generally pay only a few cents (often $0.05–$0.10 per debit transaction, regardless of the purchase amount) to process a debit card payment.

This is why debit is so cost-effective for merchants—a $20 debit purchase might cost the merchant under ten cents in fees, whereas a $20 credit card sale might incur around 30 cents in interchange (1.5% of $20) plus other fees. Interac interchange fees are effectively capped by this low fixed structure; the Retail Council of Canada notes it usually costs merchants under 10 cents to process a debit transaction (and at most around 40 cents in certain cases)

As a result, many businesses encourage debit for cost savings, especially on large ticket sizes where a percentage-based credit fee would be much higher.

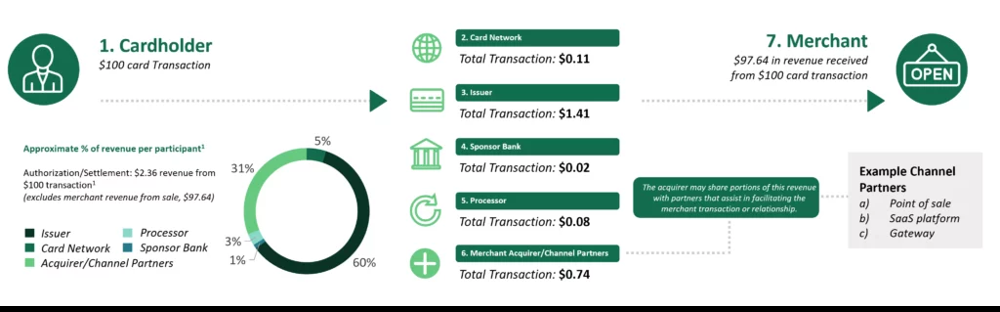

Interchange fees make up the largest portion of merchants’ card processing costs. In this illustrative breakdown of a $100 credit card sale, the merchant receives about $97.64 after fees, meaning $2.36 in fees were taken out【36†】. The issuing bank (issuer) received the biggest slice—roughly $1.41 (60% of total fees)—as interchange. The card network earned only about $0.11 (5%) in network fees, and the remainder (around $0.84) went to the acquirer/processor side【36†】. This shows how interchange fees are typically the single largest component (often 70–90% of the total fees a merchant pays on a credit card transaction)

From a merchant’s perspective, interchange matters because it directly impacts the cost of accepting cards. High interchange fees reduce the merchant’s margin on each sale

retailcouncil.org. In Canada, interchange fees have historically been high by global standards—averaging around 1.5% of credit card transaction value. However, there have been efforts to reduce this burden. In 2015, Visa and Mastercard agreed to cap the average interchange to 1.50%, and more recently they committed to further reduce it to 1.40% on average

retailcouncil.org. In fact, starting in 2020, the average interchange rate was about 1.4%, and the 2023 federal budget announced a plan to reduce interchange for small businesses by up to 27% off the current average rates

bdc.ca. The goal is to help lower costs for merchants (which can hopefully be passed on to consumers). Still, the exact interchange fee on a given transaction will vary—a small retailer might effectively pay closer to that 1.4–1.5% average, whereas a big-box store with negotiation power or a special industry rate might pay less (interchange rates can be lower for certain categories like charities or grocery stores, and larger merchants often have more volume-based pricing).

Payment Processing Assessment Fees and Network Costs

In addition to interchange, card networks charge assessment fees (also called network fees or wholesale fees) to cover the cost of maintaining the payment processing network. These are fees that Visa, Mastercard, and other networks charge to the acquirers (and ultimately pass to merchants) for each transaction routed through their networks. Assessment fees are typically much smaller than interchange, but they apply to all transactions. For instance, Visa’s assessment fee in Canada is about 0.09% of the transaction value. This means for a $100 credit card sale, Visa would charge $0.09 to the acquirer for using the Visa network. Mastercard’s assessment fees are of a similar order of magnitude (a small fraction of a percent), and they often have additional fixed per-transaction network fees or cross-border fees if the card is international. These network fees together cover things like the payment network’s operations, security, and innovation investments.

Assessment fees are built into the merchant discount rate that the acquirer/processor quotes the merchant

mastercard.ca. Merchants usually don’t see them as separate line items (unless on a very detailed statement), but it’s helpful to know they exist. For example, if your merchant service provider charges you an overall rate of 2.0% for Visa, that rate includes the interchange fee (which goes to the issuer) and the assessment fee (which goes to Visa), in addition to the acquirer or processor’s markup. Interac has its own payment processing network fees for debit, but as noted, these are flat amounts in the few-cents range. (Interac’s network is structured as a low-cost utility: they charge acquirers a small switch fee per transaction, which results in that flat fee to merchants.)

In short, assessment fees are the card network’s cut of each transaction

helcim.com. While Visa and Mastercard do not take a slice of interchange for themselves, they earn revenue through these assessments and other network fees. From a merchant’s perspective, they are generally not negotiable or avoidable—they’re a standard cost of accepting card payments, just like interchange.

Role of Acquirers and Merchant Banks

Acquiring banks (or acquirers) are the financial institutions that hold merchant accounts and enable businesses to accept card payments. In Canada, an acquirer might be a big bank or a specialized payment company. For example, Moneris is a major Canadian acquirer (jointly owned by RBC and BMO), and other acquirers include TD Merchant Solutions, Chase Paymentech, Global Payments, Desjardins, Elavon, and First Data (Fiserv), among others. If you have a merchant account for processing cards, it’s ultimately underwritten by an acquirer. The acquirer’s job is to process transactions on your behalf and settle funds to your account, while also managing the risk of those payments. When a transaction occurs, the acquirer pays the interchange fee to the issuer, and then collects the total fees from you (the merchant) via your processing agreement.

The fees a merchant pays for each transaction are often called the merchant discount rate (MDR) or simply the processing fee. This typically bundles interchange, assessment, and the acquirer’s own service fee or markup. For example, an acquirer might charge a merchant an MDR of 2.0% for a Visa credit card sale. Out of that 2.0%, the acquirer passes the interchange portion to the issuer, pays the network assessment to Visa, and retains a portion (the remainder) for itself or the payment processor as revenue for facilitating the transaction. The acquirer also handles getting the money from the issuer and crediting it to the merchant’s account. In practice, after each batch of transactions is settled, the acquirer deposits the funds into the merchant’s bank account (usually daily or next-day) minus all the applicable fees. This “minus fees” can happen either through deducting fees before deposit or depositing the gross amount and then collecting fees at month-end—but either way, the merchant ultimately pays the fees.

Acquirers in Canada must be registered participants in the card networks. If a payment processor isn’t itself a bank, it partners with an acquiring bank (often called a sponsor bank) to access Visa, Mastercard, and Interac networks. The acquiring bank bears responsibility for the merchant’s adherence to network rules and pays the network and interchange fees upstream. For their part, acquirers also often provide customer service to merchants, handle chargebacks (when a transaction is disputed and reversed), and provide the equipment or gateways needed to accept cards. In essence, the acquirer/merchant bank is your pipeline to the card economy—they make sure that when a customer pays you, the money actually moves from the customer’s card account to your business bank account.

The Role of Payment Processors like CleverPays

Payment processors are companies that provide the technology and services for handling card transactions, sitting between the merchant and the financial institutions. CleverPays, for example, is a payment processor that helps Canadian businesses accept payments in-store and online. Processors often bundle services and work in partnership with acquirers: in some cases the processor is the acquirer, in others they are an independent service provider linked to an acquiring bank. Either way, from the merchant’s point of view, the processor is who you deal with on a day-to-day basis for payment processing needs.

A card payment processing company like CleverPays typically offers point-of-sale (POS) systems, card terminals, payment gateway services for e-commerce, and other tools to make accepting payments seamless. They handle the technical side of each transaction—encrypting the card data, routing it through the networks for approval, and ensuring you get paid. For these services, the processor charges fees to the merchant, which can include a small per-transaction fee, a percentage markup, and sometimes monthly fees or equipment rentals

moneris.com. Different pricing models exist in Canada:

- Interchange-Plus: The processor passes the exact interchange fee and assessments on to the merchant and adds a fixed markup (e.g., interchange + 0.3%). This is very transparent, as you see the true cost and the processor’s take separately.

- Flat Rate: The processor charges a single flat percentage (and maybe a fixed cents amount) that covers everything. For example, a flat 2.65% on all credit transactions (like some providers offer) means you pay the same rate regardless of card type. This is simple for budgeting, though the flat rate might be higher than your effective cost on basic cards.

- Tiered Pricing: Some older models group card types into “qualified, mid-qualified, non-qualified” with different rates. This is less common now in Canada for new accounts, as most businesses prefer transparent pricing.

Modern Canadian credit card processors emphasize ease of use and transparency. For instance, some, like CleverPays and others, advertise no long-term contracts, no hidden fees, and competitive rates to win over small business customers (many even have month-to-month agreements with no cancellation penalties). Payment processors also differentiate themselves with customer support and integration: a good processor will help ensure your point-of-sale integrates with your inventory or accounting system, or that your online checkout is smooth and secure. They might offer features like next-day funding, analytics dashboards, or multi-currency processing if you sell to international customers.

Crucially, processors help with PCI compliance (ensuring card data is handled securely) and fraud prevention tools, so that small businesses don’t have to navigate these technical requirements alone. In summary, a credit card payment processor like CleverPays is your payments partner—they provide the hardware, software, and support to accept cards and often deal with the acquirer and networks on your behalf. This lets you focus on running your business while they focus on moving the money and managing the complexity behind each card swipe or tap.

Transaction Flow in Canada: Step-by-Step

When a customer makes a card purchase, the transaction follows a series of steps to move funds from the cardholder’s bank to the merchant. Here’s a simplified step-by-step of how a card transaction flows in Canada:

- Purchase Initiation: The cardholder presents their card to pay. This could be dipping or tapping a physical card on a terminal, or entering card details on an e-commerce website. The merchant’s POS system or payment gateway captures the card information and transaction amount.

- Authorization Request: The merchant’s system sends the transaction data to the payment processor/acquirer, who forwards it through the appropriate card network (Visa, Mastercard, Interac, etc.) stripe.com. This message goes to the issuing bank (the customer’s bank) to ask for approval. Think of this like asking, “Does this customer have the funds or credit available, and is this transaction legitimate?”

- Issuing Bank Response: The issuing bank’s systems check the cardholder’s account—is the account in good standing? Is there enough credit or balance? If everything checks out (and no fraud flags are raised), the issuer approves the transaction. It creates an authorization code and sends an approval message back through the network to the acquirer/processor, and then to the merchant’s terminal or websitestripe.com. If the account is over limit, has insufficient funds, or the card is reported stolen, the issuer sends a decline instead.

- Authorization Completion: The merchant receives the approval (usually within a second or two), and the sale is completed. At this point, the customer likely gets an “approved” message or receipt. No actual money has moved yet, but the funds are now reserved for this purchase. For a debit transaction via Interac, the money is typically immediately withdrawn from the customer’s bank account upon approval.

- Batching and Clearing: Throughout the day, the merchant may have many approved transactions. These are stored in a batch. After closing the business day, the merchant (or their system automatically) sends the batch of transactions for clearing and settlement. The acquiring processor then sends these to the card networks, which pass them to the respective issuing banks to be cleared.

- Settlement and Funding: The actual movement of money happens during settlement. The issuing bank transfers the funds for each transaction through the network to the acquirer. Interchange fees are deducted at this stage – for example, if the sale was $100 and interchange is $1.50, the issuer sends $98.50 to the acquirer, keeping $1.50 as interchange revenue. The card network also collects its assessment fee (e.g., a few cents) out of the flow. The acquirer receives the funds and then credits the merchant’s account for the net amount of each transaction. If the acquirer deducts their own fee upfront, the deposit the merchant gets will be the transaction amount minus all fees (interchange, assessment, and acquirer/processor fee). Often, however, Canadian acquirers deposit the full transaction amount and later (e.g., end of month) debit the accumulated fees from the merchant’s account.

- Merchant Receives Payment: Finally, the merchant’s bank account is funded with the proceeds of their card sales, typically within 1-2 business days. For instance, if you close a batch on Monday, you might see the deposit for those transactions on Tuesday (this varies by provider and type of account). At the end of the billing cycle (usually monthly), the merchant also receives a statement detailing fees—or they can see reports via an online portal showing each transaction and the fees paid.

Throughout this process, security checks are happening (for example, the network and issuer use fraud detection systems in steps 2-3). In Canada, if it’s an Interac debit transaction, the flow is slightly different in that Interac directly debits the customer’s bank and credits the merchant’s bank through its network, but from the merchant’s perspective, the steps are similar (the terminal sends to the acquirer, the Interac network approves via PIN, etc., then funds are transferred). The entire authorization process (steps 1–4) happens in seconds, making it feel instantaneous to consumers at checkout. The settlement (steps 5–7) typically happens behind the scenes at the end of the day. This is why you might see a pending charge on your credit card online banking immediately, but the merchant gets the actual money a day or two later once everything is settled through the banking system.

Payment Processing Regulations and Trends in Canada

The Canadian payments landscape is influenced by government regulations, network rules, and evolving technology. Here are some key regulations and trends:

- Interchange Fee Regulation (Voluntary Reductions): Unlike the EU, which imposes hard caps on interchange, Canada has used moral suasion and voluntary agreements to keep interchange in check. In 2018, the federal government negotiated a deal with Visa and Mastercard to lower average credit card interchange to 1.40% (down from 1.50%) for a five-year period starting in 2020. Further measures announced in 2023 aim to reduce interchange fees for small businesses by up to 27% from current levels. The government’s goal is to alleviate the cost for merchants, especially small and medium enterprises. High interchange fees have been a concern, as Canadian merchants collectively pay billions in card fees each year. The Financial Consumer Agency of Canada monitors compliance, and card networks have to publicize any interchange rate changes in advance. For now, Canada’s approach is a mix of negotiated fee relief and transparency requirements rather than strict caps.

- Code of Conduct for the Credit and Debit Card Industry: Canada has a Code of Conduct that, while voluntary, has been adopted by the major networks and acquirers. It’s designed to protect merchants by ensuring clear disclosure of fees and giving merchants some rights in the payments space. For example, the Code requires that merchants get at least 90 days notice of any fee increases or new fees. It also ensures merchants can cancel their contract without penalty if fees are hiked, and it promotes transparency in statements (so that merchants can see interchange, network fees, and processor fees broken out clearly). The Code was updated over time (with significant enhancements effective in 2015 and more coming into effect in 2025) to address emerging issues. While not a law, the networks enforce compliance with the Code as part of their network rules in Canada.

- Credit Card Surcharging: A recent development (stemming from a class-action settlement with Visa and Mastercard) is that, as of October 2022, Canadian merchants are allowed to add a surcharge to credit card transactions to offset processing costs. Outside of Quebec (where provincial law prohibits surcharges), businesses can choose to charge customers an extra fee when they pay with credit card, up to a maximum of 2.4% of the transaction. This is intended to equal roughly the average processing cost and cannot exceed what the merchant actually pays. Surcharging is optional—many merchants may opt not to surcharge for fear of displeasing customers. But the mere ability to surcharge gives merchants some leverage; even if you don’t surcharge, you can use the possibility as a negotiation point with your processor for lower rates. Debit card surcharges, however, are not permitted by the card networks (and frankly, since debit fees are low, there’s less need). It’s worth noting that if a merchant chooses to surcharge, they must follow card network rules on disclosure (clearly informing customers before payment) and have to register with Visa/Mastercard in advance.

- Debit Card Dominance and Interac: Canada is somewhat unique in that debit cards run over the domestic Interac network, which has kept debit costs low. Nearly every Canadian bank issues Interac debit cards, and they are used for point-of-sale and increasingly for e-commerce (e.g., Interac Debit online, and Interac e-Transfer for peer-to-peer payments). Interac Flash (contactless debit) allows tap payments for debit, and it gained popularity, especially after contactless transaction limits increased (up to $250 for Interac Flash). The regulatory environment has favoured keeping debit affordable—for example, any co-badged debit cards (ones that have Interac + Visa Debit on the same card) must route domestic transactions through Interac, so that merchants aren’t forced into higher-cost Visa routing for domestic debit payments. In terms of trends, debit card usage in Canada remains very strong for everyday purchases, while credit cards are often used for larger or online purchases (where people may prefer the rewards or purchase protection).

- Contactless Payments and Digital Wallets: Canadians have rapidly adopted tap-to-pay via contactless cards and mobile wallets. Services like Apple Pay, Google Pay, and Samsung Pay are widely supported by Canadian banks, meaning customers can pay with a tap of their phone or smartwatch. From the merchant’s perspective, a mobile wallet transaction is processed as a normal Visa/Mastercard/Interac transaction (the wallet is just using the card stored in it). During the COVID-19 pandemic, contactless payments surged for safety and convenience. Today, many businesses find that a large share of their transactions are contactless—and this trend is only growing. Digital wallets offer speed and convenience, and they also enable emerging tech like in-app payments or scan-and-go retail experiences. For merchants, it’s important to have up-to-date terminals that support contactless and mobile wallet acceptance, since consumers now expect it. The good news is the fees are the same as traditional card transactions; there’s no extra fee for accepting Apple Pay, for example—it rides the card’s network rails.

- E-Commerce and Security: As more commerce moves online, Canadian businesses are using payment gateways to accept cards on websites and apps. Online fraud prevention is a big focus—tools like Address Verification (AVS), CVV checks, and 3-D Secure (Verified by Visa / Mastercard SecureCode) help reduce fraud. The card networks in Canada encourage the use of these tools by offering lower interchange rates for transactions that meet certain security criteria (for instance, there are slightly lower interchange rates for e-commerce transactions that use 3-D Secure, as an incentive). Regulations around data privacy (like federal PIPEDA) and card industry standards (PCI DSS) mean merchants must handle customer data carefully. Payment processors often assist with tokenization (so that merchants don’t store raw card numbers) and other compliance steps.

- Real-Time Payments and Future Trends: Beyond cards, Canada is modernizing its payments infrastructure. Payments Canada (the non-profit organization that runs the core payment clearing systems) has been working on the Real-Time Rail (RTR)—a new real-time payment system that will allow instant, 24/7 bank-to-bank payments. While the project has faced delays (expected launch now around 2025-2026), the RTR will eventually enable Canadians and businesses to send and receive funds in seconds, outside of traditional card networks. This could introduce new competition for small-value payments or peer-to-peer transfers (think paying directly from your bank account with instant confirmation, as an alternative to cash or even cards in some cases). Meanwhile, the existing Interac e-Transfer service functions as a near-real-time payment option widely used for P2P and business payments, and it continues to grow. Another trend is the rise of “buy now, pay later” (BNPL) services and other fintech-driven payment options, which some merchants integrate to give customers more choice at checkout.

Looking ahead, Canadian businesses should keep an eye on these trends. Accepting mobile and online payments securely will be an ongoing need, and the evolution of real-time payments may open new ways to get paid or pay suppliers without card fees. However, for the foreseeable future, credit and debit cards remain the dominant payment methods for consumers, and understanding interchange fees and the roles of processors and banks will help you navigate the costs. By staying informed on the fees and leveraging competition among processors, and by being aware of regulatory changes (like interchange reductions or surcharging rules), you can make savvy decisions that improve your bottom line while still offering your customers a convenient payment experience.